Billions flood into political betting market ahead of 2024 election

Betting markets not comparable to polls, political analyst says

This is the Virginia Scope daily newsletter covering Virginia politics from top to bottom. Please consider becoming the ultimate political insider by supporting non-partisan, independent news and becoming a paid subscriber to this newsletter today.

Have a tip? You can reply to this email or reach out to me directly at Brandon@virginiascope.com.

Consider making a donation to help Virginia Scope and the Virginia Political Newsletter expand as we move forward into coverage of 2025 elections in Virginia.

Billions flood into political betting market ahead of 2024 election

By Stacy Watkins, Capital News Service

RICHMOND, Va. -- Americans can now cast a ballot in the 2024 presidential election, and also place a bet on who will win.

The U.S. Court of Appeals for the D.C. Circuit made it legal to wager on U.S. politics, just a month ahead of the presidential election. The court ruled that financial regulators could not block the New York-based company Kalshi from being able to accept political bets.

Kalshi is a prediction market which allows users to place bets, called “event contracts,” on a wide range of scenarios, including political races. These platforms are focused on the outcome of future events, in a similar way to the outcome of a sports event.

Investment company Robinhood also jumped into the political futures prediction market field right before Halloween and announced its users can also place wagers on the upcoming election.

People have become more familiar with sports betting, and as that has happened, the market has grown with other companies that allow users to bet on future outcomes.

Some of the trading scenarios on Kalshi’s website currently range from how many swing states will former President Donald Trump win, to if the number of bird flu cases will go above 50, or 100.

The Commodity Futures Trading Commission, or CFTC, claimed Kalshi’s system of trading on candidates could involve unlawful activity or gaming. The company was banned from being listed or available for clearing or trading, according to its press release.

Discussions about political betting have taken place for years within the CFTC, but according to a May statement from CFTC Chairman Rostin Behnam, more event contracts were listed for trading in 2021 than had been listed in the prior 15 years total. The commission wanted to specify what contracts were allowed, and stated that political event contracts “ultimately commoditize and degrade the integrity” of the democratic electoral process.

“Allowing these contracts would push the CFTC, a financial market regulator, into a position far beyond its Congressional mandate and expertise,” Behnam stated. “To be blunt, such contracts would put the CTFC in the role of an election cop.”

Kalshi sued the CFTC, and claimed the commission had “exceeded its lawful authority,” according to a filed complaint.

The U.S. Court of Appeals for the D.C. Circuit ruled in Kalshi’s favor and concluded the CFTC use of the word “gaming” was too broad. The court determined the CFTC did not show how the public would be harmed by trading with Kalshi, that democracy would not be undermined and that much of the regulatory agency’s arguments were not sound.

Kalshi’s user base has doubled “day over day” since the October ruling, CEO Tarek Mansour told The Washington Post. The company did not respond to a VCU Capital News Service request for an interview.

Kalshi started to accept wagers on the 2024 congressional races less than an hour after the ruling, according to The Washington Post.

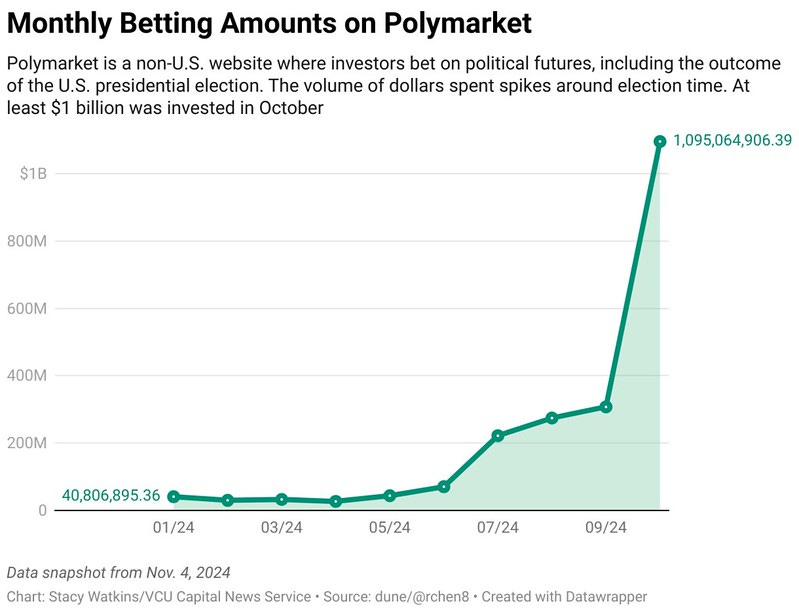

Americans have already bet over $100 million on the presidential election, according to a recent NPR report. Kalshi isn’t the only company that has generated millions through future political events. Around $2 billion has been wagered on Polymarket, which is open to non-U.S. investors. Over $1 billion was wagered in October, according to Polymarket data.

Polymarket traders favor Trump to win the 2024 election. At least $1.25 billion was placed on Trump to win, as of Nov. 4, according to Polymarket. At least $790 million has been placed on Vice President Kamala Harris to win.

Investors and corporations could have an interest in a Trump victory. Trump made a campaign promise to extend and modify the Tax Cuts and Jobs Act to offer a 15% corporate tax rate. He reduced the rate from 35% to 21% when he was president. A central part of the Harris plan is to extend the TCJA to people earning under $400,000. Harris would increase the corporate tax rate to 28%.

Trump was a business tycoon and celebrity figure before he became the 45th president. His wealthiest supporter this election, Elon Musk, stated in a post on X that “betting markets are more reliable than polls, since money is on the line.”

Ultimately, people determine who will win the election. Trading markets only represent traders, not the entire American electorate. Sometimes the betting markets are right, and other times have completely missed the mark, according to The New York Times.

An average of 25 national polls shows Harris and Trump essentially tied, with each candidate within the error of margin, according to polling analysis from 270toWin. Polling through design is intended to be a representative sample of the public.

Political experts study data and understand electoral nuances. Still, even pollsters can make inaccurate predictions. The nation was surprised by Trump’s 2016 win, with national polls predicting a victory for Hillary Clinton, according to CBS News.

Betting markets potentially could be used to sway public opinion and election outcomes.

Stephen Farnsworth is a professor of political science at the University of Mary Washington, and the director of its Center for Leadership and Media Studies. Betting markets should not be considered comparable to polls, as these markets can be prone to bias that is hard to detect, Farnsworth stated.

People could try to game the system with their bets, putting money down to try to obtain their desired outcome, rather than to express their honest prediction of an election, according to Farnsworth.

Laura Beers is a professor of history at American University who has published work on political betting in Britain. Politicians used betting markets to interpret and influence public opinion even over a 100 years ago, she stated in an article. Beers did not respond to an interview request.

Citizens would look at betting odds as clues to see which parties stood the best chance of winning, according to Beers.

Roy Gichuru is a junior who studies aerospace engineering at Virginia Tech. He first heard about being able to place money on the election through Robinhood. He believes political trading will become a new way to make money in the future. Gichuru does not bet on sports, he said.

“I see political bettings are gonna be a thing of the future now,” Gichuru said.

Political trading is a “quick money grab scheme” and another form of lobbying, with people trying to get a candidate they want, he said.

“This is something we’ve never seen before, right?” Gichuru said. “So this is a new way of making money, and people are always going to come up with new ways of making money.”