A survey of Virginia Republicans on immigration for primary day

The FTC sent a letter to Virginia lawmakers about junk fees.

This is a daily newsletter covering Virginia politics from top to bottom. Please consider becoming the ultimate political insider by supporting non-partisan, independent news and becoming a paid subscriber to this newsletter today.

Correction: The newsletter this morning said the arena would be in Arlington, but it will actually be in Alexandria if approved.

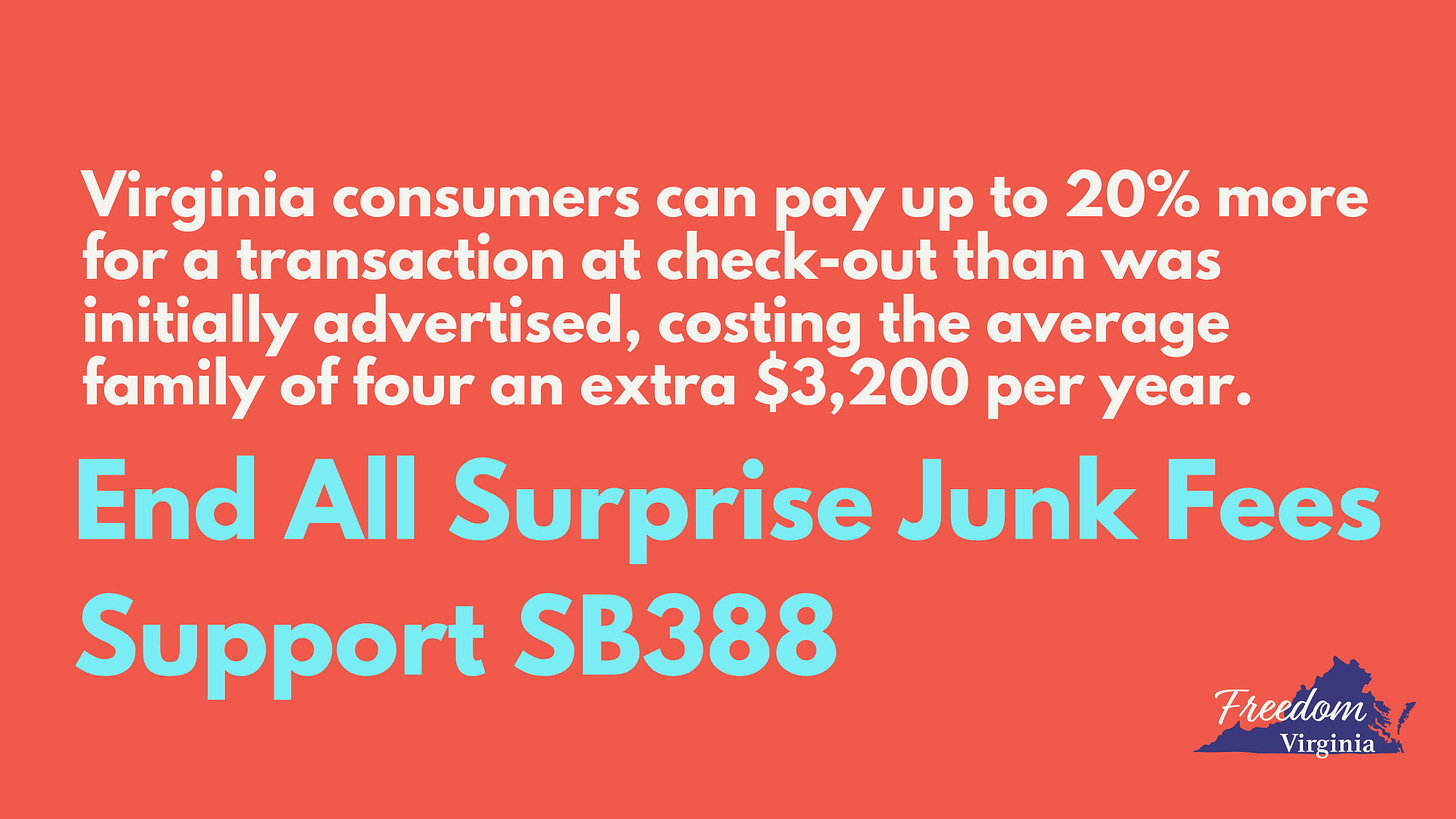

Today’s Sponsor: Freedom Virginia

Both the House and Senate agree that Virginians need transparency in pricing. As this legislation moves forward, Freedom Virginia encourages legislators to adopt a comprehensive approach that bans junk fees across the entire economy, including on rental cars, credit cards, phone upgrades, meal delivery, and more.

The rundown

Polling from a Republican research firm shows that the majority of Virginia Republicans say they do not support expanding healthcare access to illegal immigrants.

Samuel Levine, the director of the Bureau of Consumer Protection at the Federal Trade Commission, sent Virginia officials a letter discussing their efforts to address junk fees on purchases as lawmakers in the General Assembly deliberate legislation that would ban junk fees.

Polling Virginia Republicans on immigration

Polling from a Republican research firm shows that the majority of Virginia Republicans say they do not support expanding healthcare access to illegal immigrants.

The Tyson Group commissioned the polling. They have a 1.2 out of 3-star rating on FiveThirtyEight pollster ratings.

From the survey:

79% of likely GOP primary voters in Virginia said stopping illegal immigration is a very important issue to them when deciding who to support for president, that was second only to improving the economy at 85%.

80% of likely GOP primary voters in Virginia oppose states expanding access to subsidized health care for illegal immigrants.

77% of likely GOP primary voters in Virginia would be less likely to vote for an elected official who has supported weak immigration enforcement legislation.

81% of respondents have a favorable view of Gov. Glenn Youngkin.

8% of Republicans have an unfavorable view of Youngkin.

62% of respondents said they would be less likely to support Youngkin for higher office if he signed any laws that would help expand access to illegal immigrants.

FTC weighs in on junk fees

Samuel Levine, the director of the Bureau of Consumer Protection at the Federal Trade Commission, sent Virginia officials a letter discussing their efforts to address junk fees on purchases as lawmakers in the General Assembly deliberate legislation that would ban junk fees.

Two bills have advanced in the General Assembly to address junk fees.

State Sen. Stella Pekarsky, D-Fairfax, has a comprehensive bill that would prevent companies from charging surprise junk fees when making an online purchase. Del. Dan Helmer, D-Fairfax, has a similar version in the House, but it only covers event purchases.

The differences between the two bills will have to be resolved between House and Senate conferees.

You can read the full letter that Levine sent to lawmakers and Gov. Glenn Youngkin below:

Dear Speaker Scott, Majority Leader Herring, Minority Leader Gilbert, Delegate Ward, and Delegate Lopez:

I understand that the Virginia Senate passed Senate Bill 388 to address junk fees and that the legislation is now being considered by Virginia’s House of Delegates. As the Director of the Bureau of Consumer Protection of the Federal Trade Commission (“FTC”), I write to provide information about the FTC’s concurrent efforts to address junk fees. The views in this letter are my own and do not necessarily reflect the views of the FTC or any individual Commissioner.

American consumers, workers, and small businesses today are swamped with junk fees that frustrate consumers, erode trust, impair comparison shopping, and facilitate inflation. Junk fees refer to unfair or deceptive fees that are charged for goods or services that have little or no added value to the consumer, including goods or services that consumers would reasonably assume to be included within the overall advertised price. Some junk fees are also “hidden,” meaning they are disclosed only at a later stage in the consumer’s purchasing process or not at all. Junk fees manifest in markets ranging from hotels to auto financing and live-event ticketing—they are not only are widespread but are also growing. Such fees impose substantial economic harms on consumers and impede the dissemination of important market information.

Enforcement Efforts

Consumers have long expressed concerns to the FTC about the prevalence of junk fees across a range of industries, and the FTC has employed a variety of tools to understand and address them. The FTC has engaged in a number of enforcement actions against companies that the FTC alleged charged unfair or deceptive junk fees in violation of Section 5 of the FTC Act, 15 U.S.C. § 45(a),0F1 and other statutes that the FTC has the authority to enforce. For example, the Commission took action against Vonage, an internet phone service provider, requiring the company to pay $100 million in refunds to consumers that were allegedly trapped into subscriptions and hit with surprise early termination fees. The Commission also took action against Passport Automotive Group and its top executives for allegedly tacking hundreds to thousands of dollars in illegal junk fees onto car prices and discriminating against Black and Latino consumers with higher financing costs. In the summer of 2022, the FTC took action against healthcare company Benefytt Technologies for allegedly selling sham insurance and charging people with exorbitant junk fees for unwanted add-ons without their permission. The company was required to pay $100 million in refunds.5F6

Research and Outreach

Prior to and alongside its enforcement efforts, the FTC sought comments about and analyzed junk fees through workshops and reports. In 2012, the FTC hosted a workshop on drip pricing, a pricing technique in which firms advertise only part of a product’s price and reveal other charges later as the customer goes through the buying process. In 2017, the FTC published a report analyzing the costs and benefits of disclosing resort fees, which are per-room, per-night, mandatory fees charged by some hotels. The report concluded that “separating mandatory resort fees from posted room rates without first disclosing the total price is likely to harm consumers by increasing the search costs and cognitive costs of finding and choosing hotel accommodations” and that it was “unlikely to result in benefits that offset the likely harm to consumers.”

In 2019, the FTC hosted a workshop that featured a panel on pricing and fee issues in the market for live-event tickets and issued a corresponding staff report.9F10 The workshop revealed that market participants believed they could not correct course without regulatory intervention. For example, after a market leader took unilateral action to phase out hidden fees, the platform “lost significant market share and abandoned the policy after a year because consumers perceived the platform’s advertised prices to be higher than its competitors’ displayed prices.” Ticket sellers who participated in the workshop that did not provide upfront all-in pricing “favored requiring all-in pricing through federal legislation or rulemaking.

Proposed Rulemaking

In October 2022, the FTC issued an advance notice of proposed rulemaking (“ANPR”) seeking public comment on a potential rule to address junk fees proliferating throughout the economy. The ANPR sought public comment on the prevalence of junk fees, the unfair or deceptive tactics companies use to impose them, the harms caused by junk fees, and whether a new rule would better protect consumers. Consumers and industry members demonstrated strong interest in the questions posed by the ANPR: the FTC received 12,046 comments in response, which overwhelmingly expressed frustration with unexplained mandatory fees.

Many ANPR comments raised concerns that sellers fail to disclose the total amount consumers will pay, misrepresent the amount, and only disclose fees after consumers have expended time in the purchasing transaction. Many comments also stated that sellers do not adequately disclose or misrepresent the nature or purpose of fees, using vague names for fees or using fees as a profit generator instead of providing consumers with services. The comments related to a wide range of goods and services, such as ticket sales, hotels, vacation rentals, apartment rentals, tax preparation services, restaurants, delivery services, utilities, telephone, internet, and cable services, and auto sales.

More recently, in October 2023, the FTC announced a notice of proposed rulemaking (“NPRM”) and sought public comment on a proposed rule. The proposed rule seeks to ban hidden fees by prohibiting businesses from advertising prices that hide or leave out mandatory fees. The proposed rule would also prohibit sellers from misrepresenting fees and require certain disclosures about the nature and purpose of fees. The FTC received more than 60,000 comments on the NPRM, and FTC staff is currently analyzing the comments to determine the appropriate next steps.

Thank you for the opportunity to provide information about the FTC’s efforts to address junk fees at the federal level. I hope that the FTC’s work provides useful insight as you consider legislation addressing junk fees in Virginia. To the extent the Federal Trade Commission can provide assistance with these inquiries, please do not hesitate to contact me.

Very truly yours,

Samuel Levine

Director, Bureau of Consumer Protection

Federal Trade Commission

(Youngkin and Pekarsky were copied on the letter.)

Additional Sponsor:

We have a monumental opportunity to have two professional sports teams & a new entertainment district in northern Virginia that will create economic growth, new shopping & dining options, more housing, and more local entertainment. It's a win-win-win. Learn more: monumentalopportunity.com